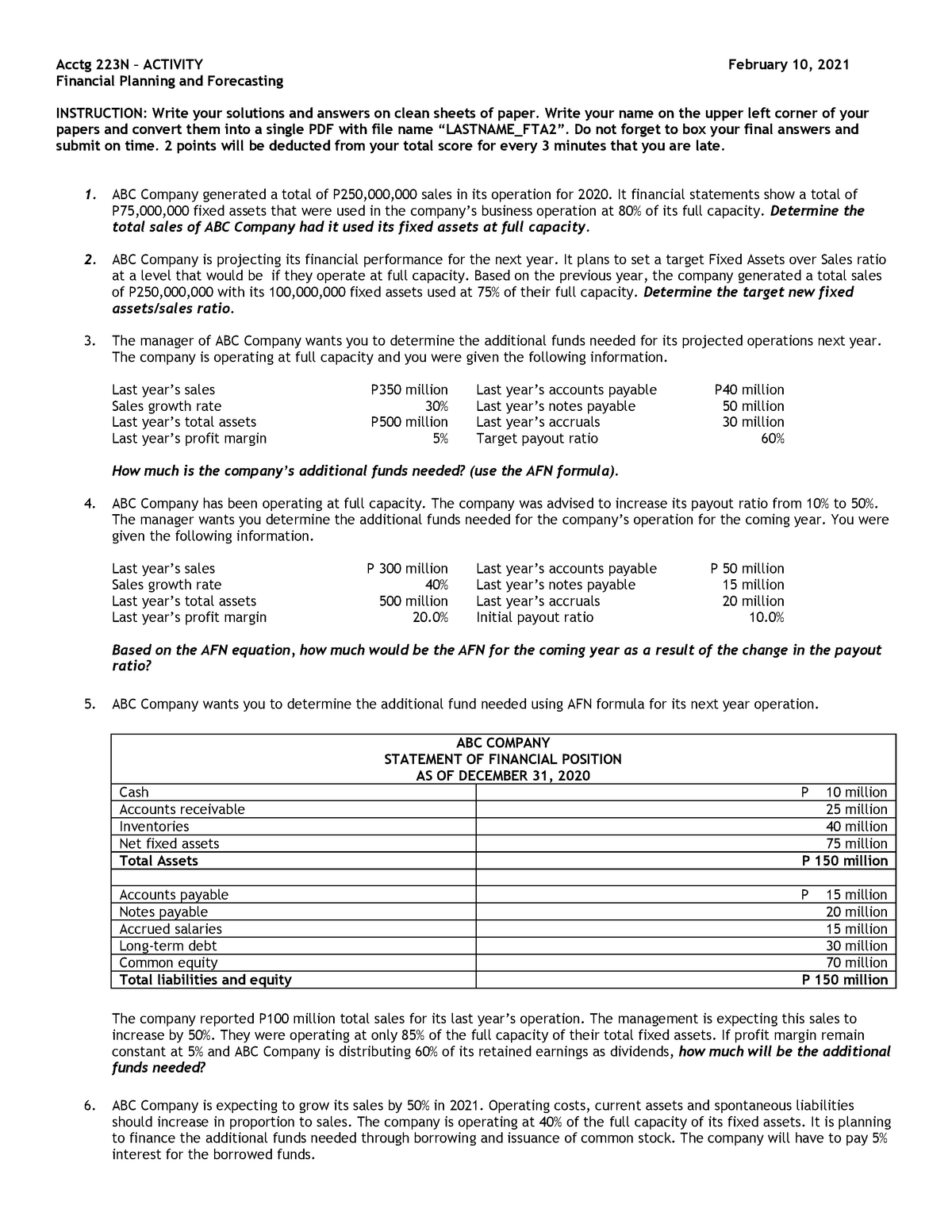

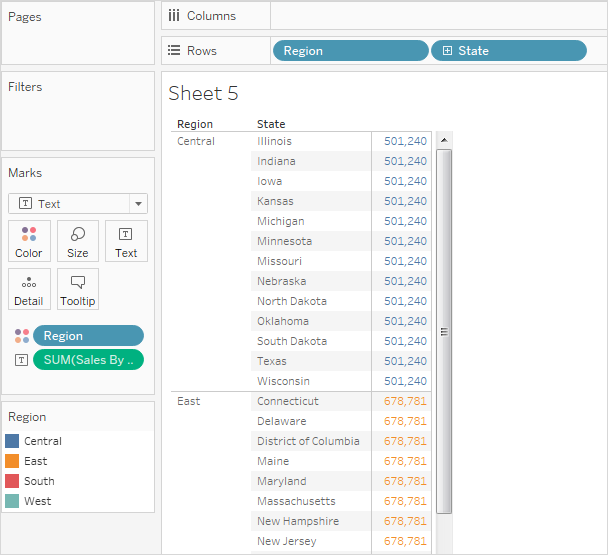

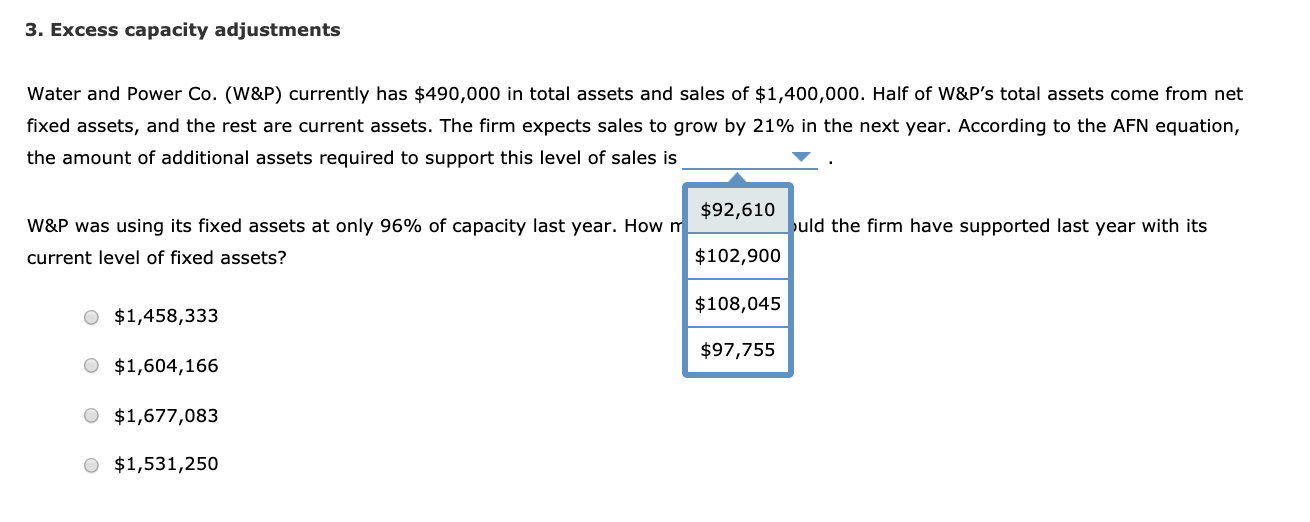

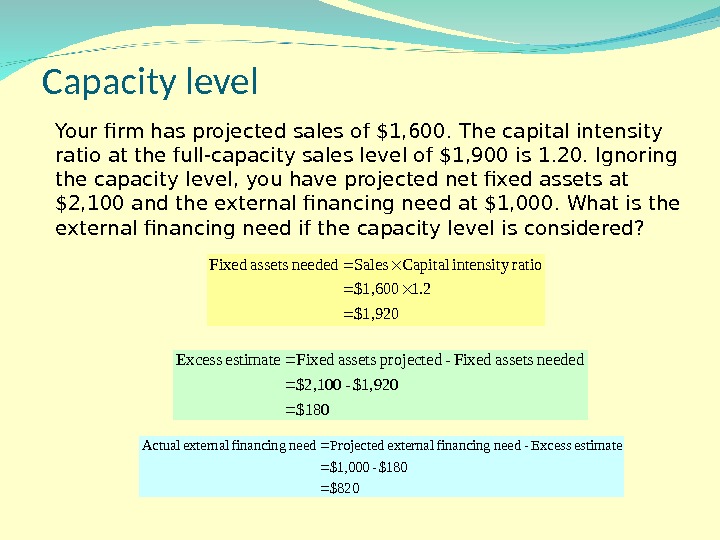

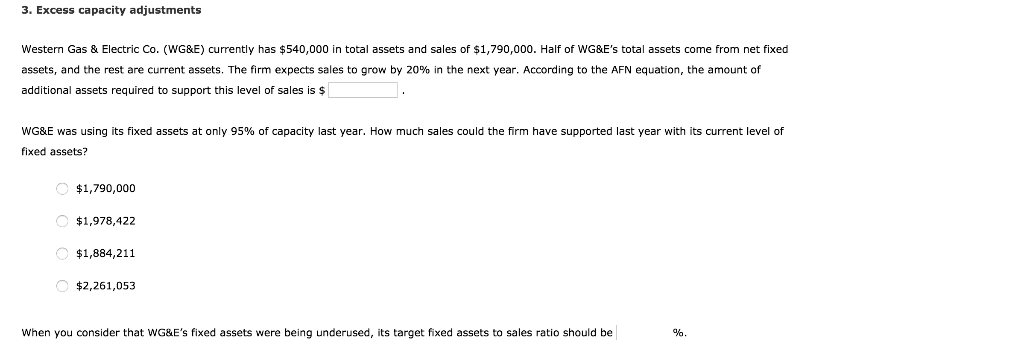

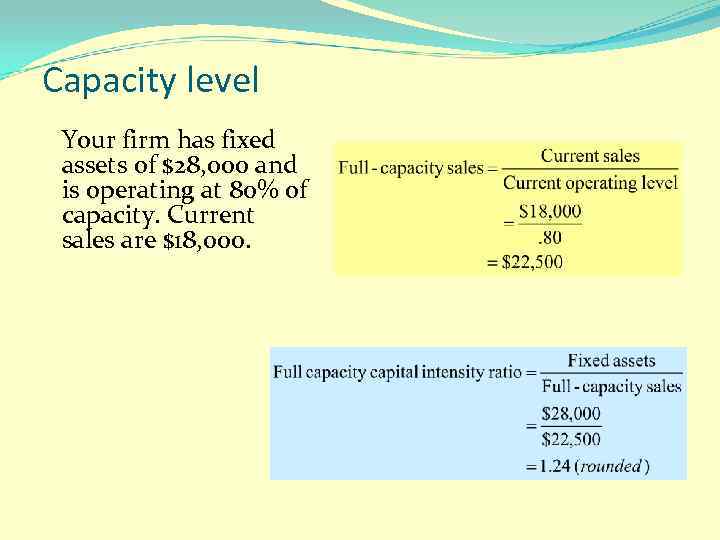

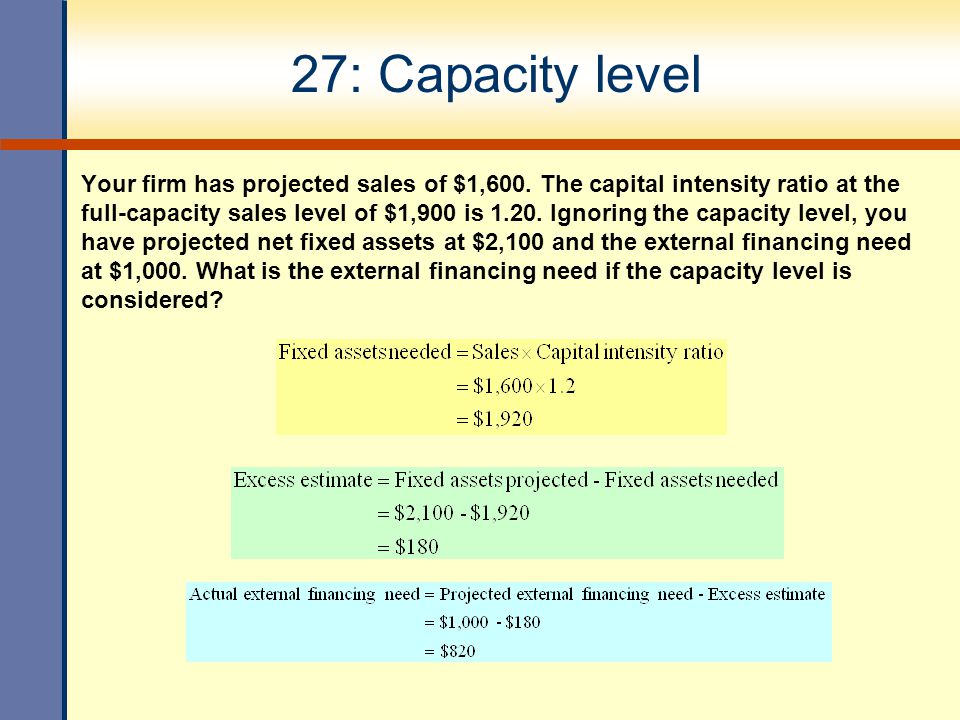

Full Capacity Sales Definition The amount of sales when machines are 100% utilized If S1>Full Capacity Sales you need to buy a new machine > calculate AFN AFN Equation Variable Definitions A*= assest that grow spontaneously with sales (accounts receive and inventory) S0= current salesIn accounting, the margin of safety is calculated by subtracting the breakeven point amount from the actual or budgeted sales and then dividing by sales;The margin of safety is a ratio measuring the gap between sales and breakeven point or the difference between market value and intrinsic value The formula for margin of safety requires two variables current/estimated sales and breakeven point The term margin of safety is used in different contexts but most of them have a similar meaning in

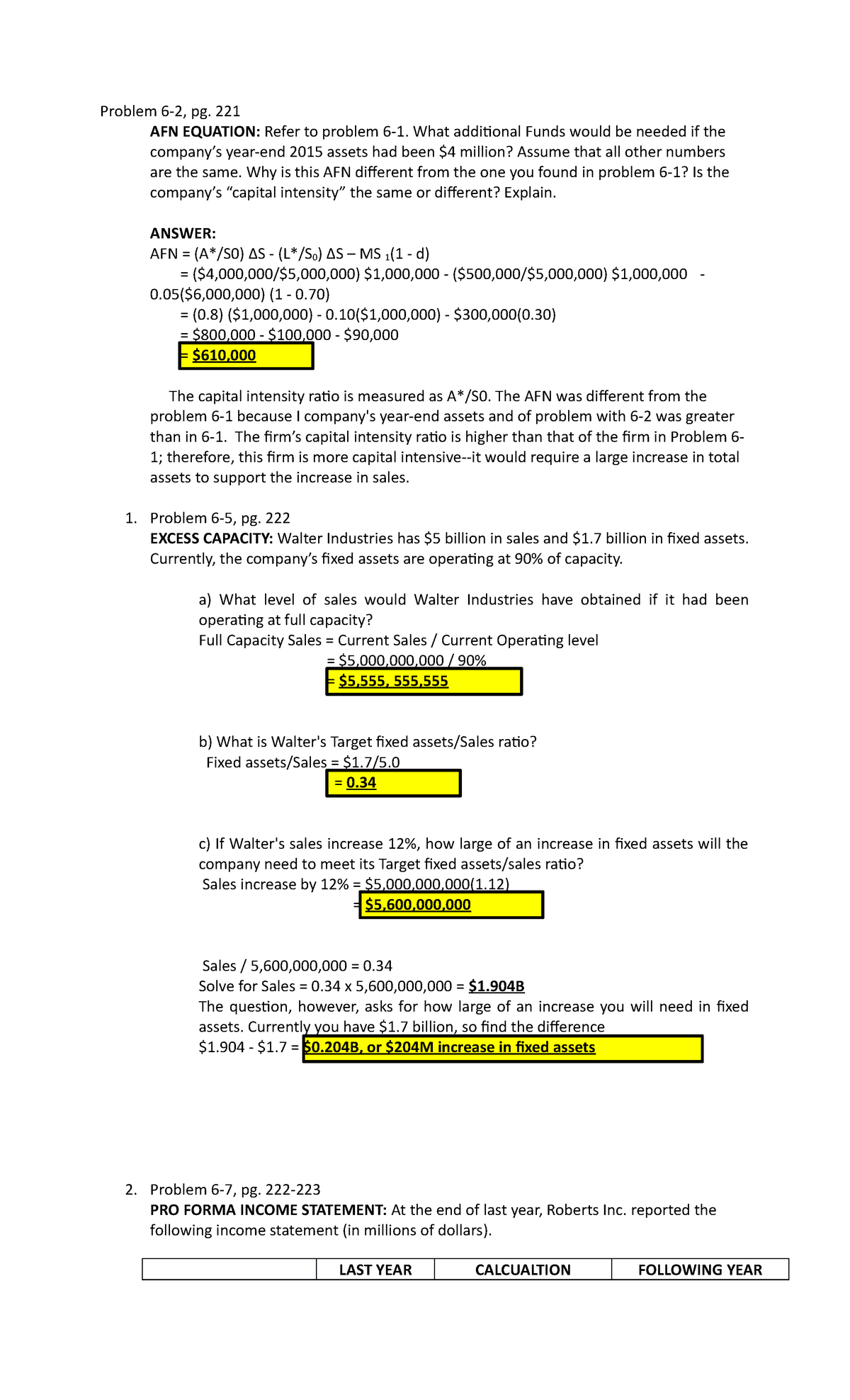

Financial Management Case Problem 6 2 Pg 221 Afn Equation Refer To Problem 6 1 What Additional Studocu

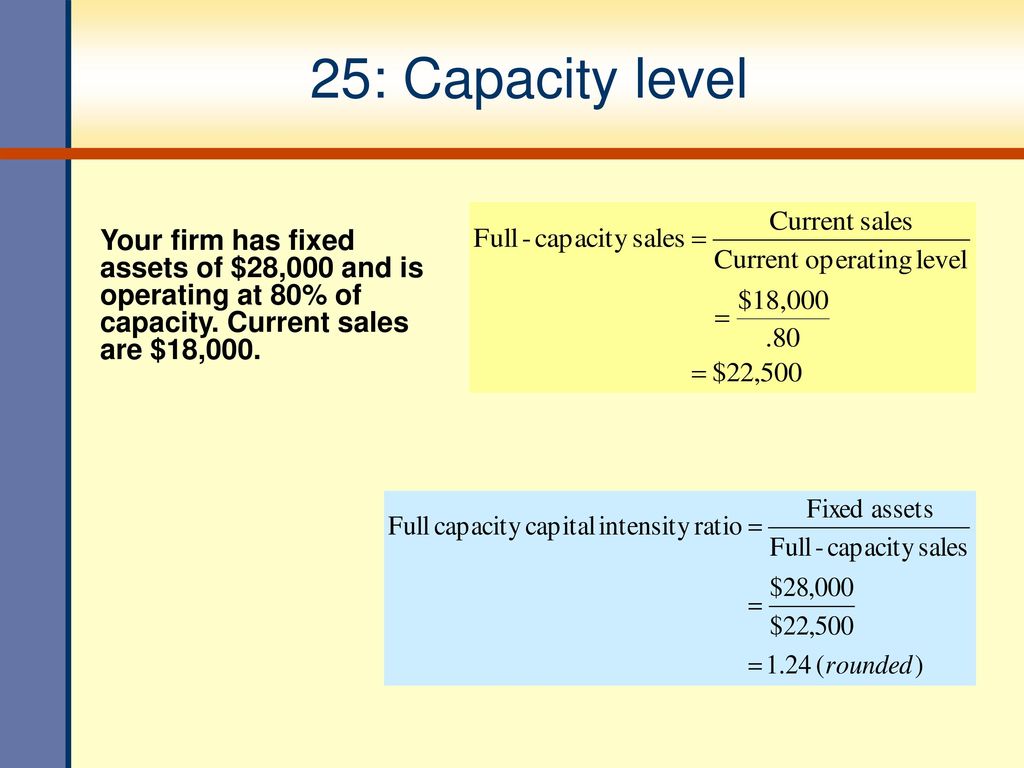

Full capacity level of sales formula

Full capacity level of sales formula-A)Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate existing sales level B)Fullcapacity sales = Future sales level ÷ (1 Percent of capacity used to generate existing sales level) C)Fullcapacity sales = Future sales level ÷ Percent of capacity used to14 A firm's profit margin is 5%, its debt/assets ratio is 56%, and its dividend payout ratio is 40% If the firm is operating at less than full capacity, then sales could increase to some extent without the need for external funds, but if it is operating at full capacity with respect to all assets, including fixed assets, then any positive growth in sales will require some external financing

Quantitative Skills Calculations Worksheet V2

Capacity costs are expenditures made to provide a certain volume of goods or services to customers For example, a company may operate a production line on three shifts in order to provide goods to its customers in a timely manner Each successive shift constitutes an incremental capacity cost The sales potential method builds on the workload method but adjusts for individual levels of effort and abilities Step 1 Take the estimated number of sales people needed under the workforce method as a starting point Step 2 Assume that this estimate is for a sales force that consists exclusively of "average sales people"Fullcapacity sales = Existing sales level ÃPercent of capacity used to generate existing sales levelb ?

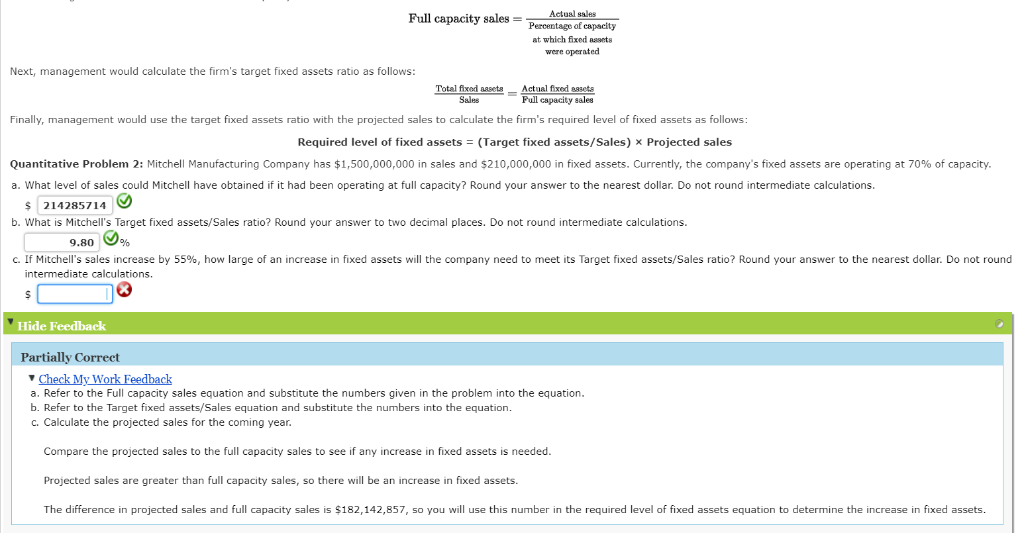

Mitchell Manufacturing Company has $1,0,000,000 in sales and $260,000,000 in fixed assets Currently, the company's fixed assets are operating at 80% of capacityWhat is the formula for calculating the fullcapacity sales of a firm?Fullcapacity sales = Future sales level Ã(1 Percent of capacity used to generate future sales level)c ?Fullcapacity sales = Existing sales level ÃPercent of capacity used to generate future sales leveld ?

Building a sales capacity plan can be a real challenge, especially if you're doing it in Excel According to Lightspeed Venture Partners, 1 out of every 3 companies doesn't even have a capacity planIn this post, I'll dive into the math behind capacity modeling, and show you how easily doing it wrong could tank your entire companyThe result is expressed as a percentage Margin of Safety = (Current Sales Level – Breakeven Point) / Current Sales Level x 100 The margin of safety formula can also be expressed in dollar Normal capacity takes into account the downtime associated with periodic maintenance activities, crewing problems, and so forth When budgeting for the amount of production that can be attained, normal capacity should be used, rather than the theoretical capacity level, since the probability of attaining normal capacity is quite high The

Capacity Planning Basics Part 1 Of 2 Wfmanagement

Www Nust Na Sites Default Files Documents Cma611s 16 Cma311s notes 10 29 unit 1 Pdf

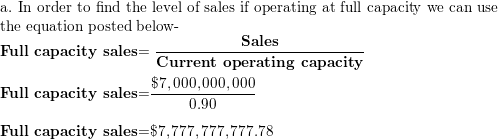

You can measure employee productivity with the labor productivity equation total output / total input Let's say your company generated $80,000 worth of goods or services (output) utilizing 1,500 labor hours (input) To calculate your company's labor productivity, you would divide 80,000 by 1,500, which equals 53What is the full capacity level of sales Last month, I wrote two articles on blind spots to invest the origins of blind spots and how to handle them Since then, I've received some really good feedback One of the readers brought up a good point There is no shortage of information about public companies and industries Too much, in factFirst, we need to calculate full capacity sales, which is Full capacity sales = $905,000 / 80 Full capacity sales = $1,131,250 The capital intensity ratio at full capacity sales is Capital intensity ratio = Fixed assets / Full capacity sales Capital intensity ratio = $364,000 / $1,131,250 Capital intensity ratio = The fixed assets

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Capacity Utilization Rate Formula Calculator Excel Template

Capital Intensity Ratio Formula You can calculate the capital intensity ratio by dividing a company's total assets by its sales or taking its reciprocal of total assets turnover ratio, as you can see in the formulas below For this type of ratio, smaller figures are better The lower the ratio, the less capital you need to operate your business Your sales capacity is the answer you obtain from the following equation the number of sales reps you have on the team, multiplied by the number of weekly hours that your team works per year, multiplied by the percentage of time spent selling and finally multiplied by the closing ratio of your team (typically about 30%)Accordingly, what level of sales can the company have at full capacity?

Tink Inc Currently Has 575 000 In Total Assets And Chegg Com

Sales Revenue Definition Formula How To Calculate

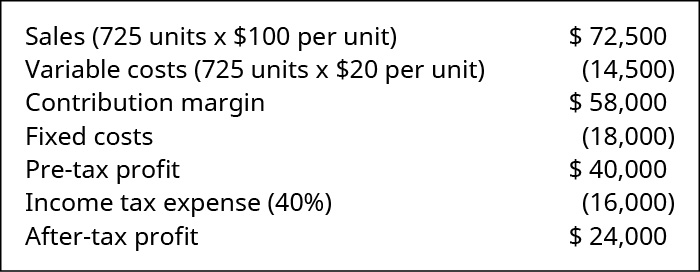

Sale (in units) = Fixed Expenses Profit/Contribution per unit = 1,50,000 87,500/5 = 2,37,500/5 = 47,500 units Sales = = 47,500 units @ Rs 15 = Rs 7,12,500 Illustration 6 The following figures relate to one year's working at 100 per cent capacity level in a manufacturing business Fixed Overheads – Rs 1,,000 Where, A o = current level of assets L o = current level of liabilities ΔS/S o = percentage increase in sales ie change in sales divided by current sales S 1 = new level of sales PM = profit margin b = retention rate = 1 – payout rate A negative figure for additional funds needed means that there is a surplus of capitalA) Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate existing sales level B) Fullcapacity sales = Future sales level ÷ (1 Percent of capacity used to generate future sales level) C) Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate future sales level

Calculate Teep Measure Utilization And Capacity Oee

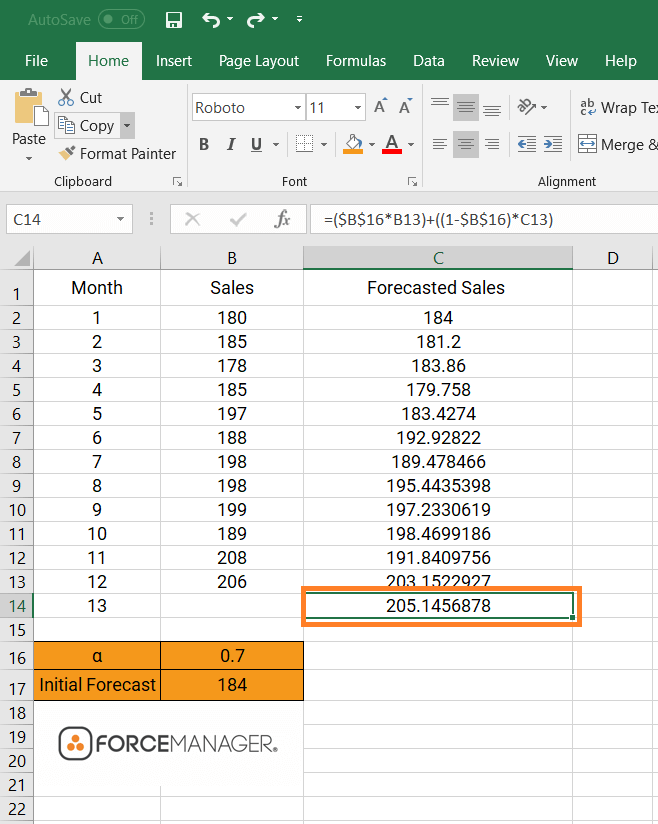

How To Do A Sales Forecast In Excel With Exponential Smoothing

1 Forecast Calculation Range of sales history to use in calculating growth factor (processing option 2a) = 3 in this example Sum the final three months of 05 114 119 137 = 370 Sum the same three months for the previous year 123 139 Q7 In the formula Production capacity (in pieces) = (Capacity in hours*60/product SAM)* line efficiency What is (60) in this formula I cannot figure it out Please help Answer In the formula, 60 is used to convert hours into minutes Garment SAM is in minute, but we the calculated factory capacity is in hours (see step#1) The formula for capacityutilization rate is actual output divided by the potential output For example, say that a business has the capacity to produce 1,600 widgets a day as in the above example, but is only producing 1,400 The capacity utilization rate is 1,400 over 1,600, or 875 percent The higher the percentage, the closer the business

Quantitative Skills Calculations Worksheet V2

How Can I Calculate Break Even Analysis In Excel

選択した画像 full capacity level of sales formula How to calculate sales capacity /03/ In accounting, the margin of safety is calculated by subtracting the breakeven point amount from the actual or budgeted sales and then dividing by sales; What is Capacity Cost? A resource planning formula will use several important variables First, you need to understand the FullTime Equivalent or FTE of employees FTE is a unit of measure that indicates the amount of capacity or availability of an individual to work during a specified time period You're probably already familiar with FTE, but if you are experiencing a lot of resource conflicts, the

Activity On Forecasting Basic Accounting Ba101 Studocu

The Impact Of Covid 19 On Potential Output In The Euro Area

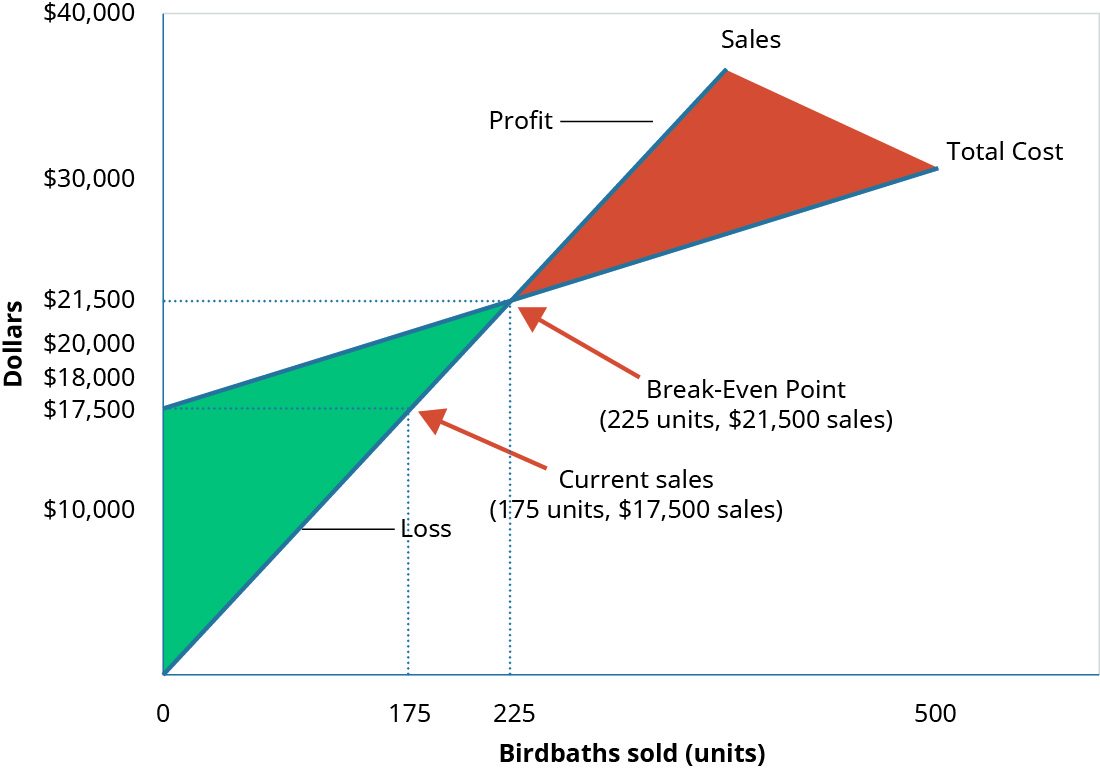

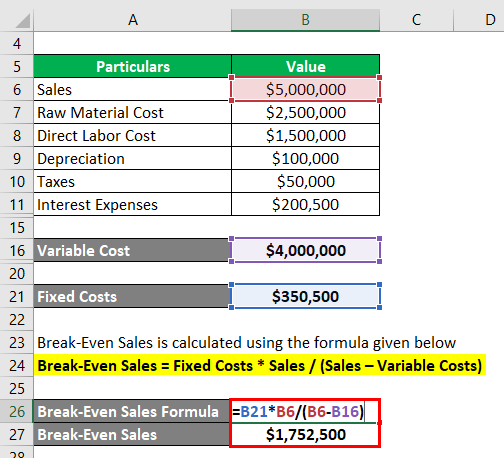

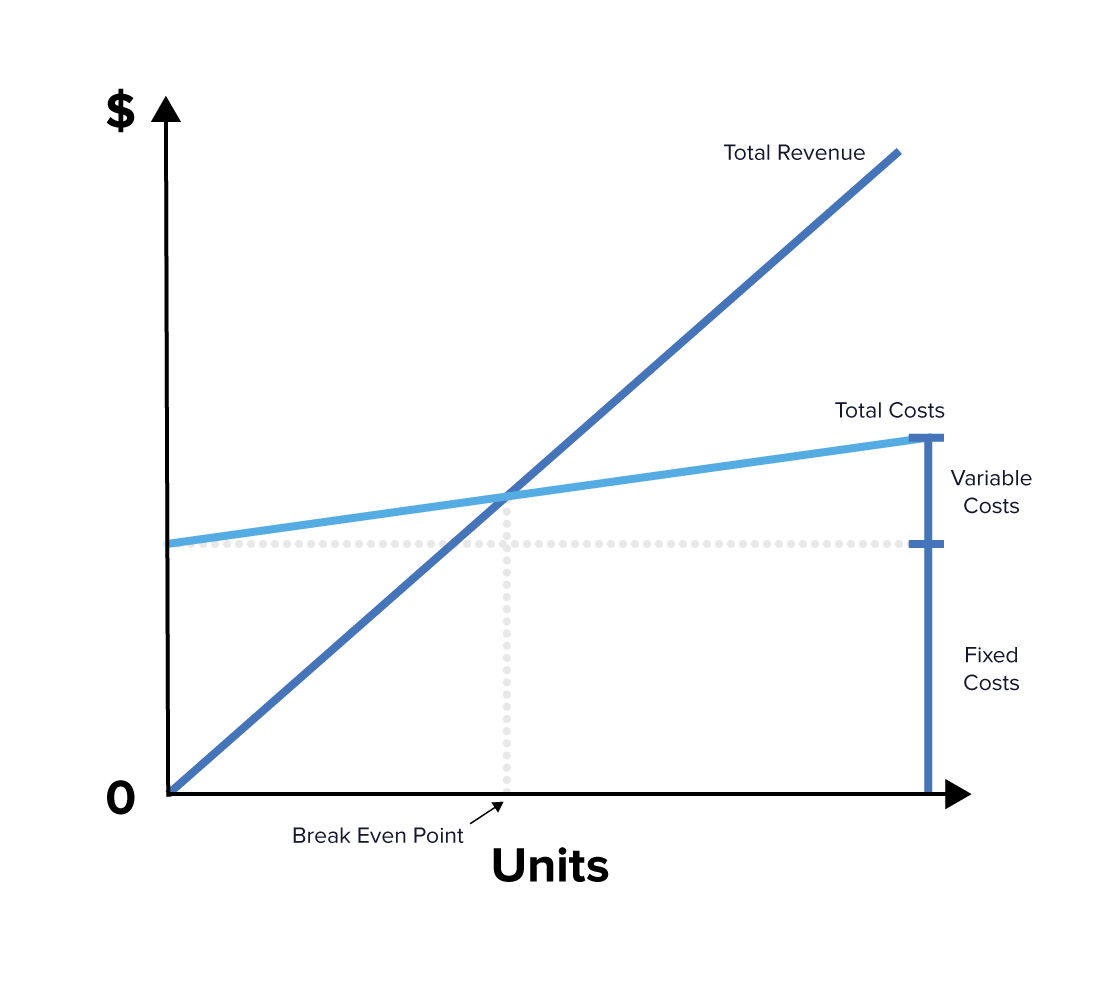

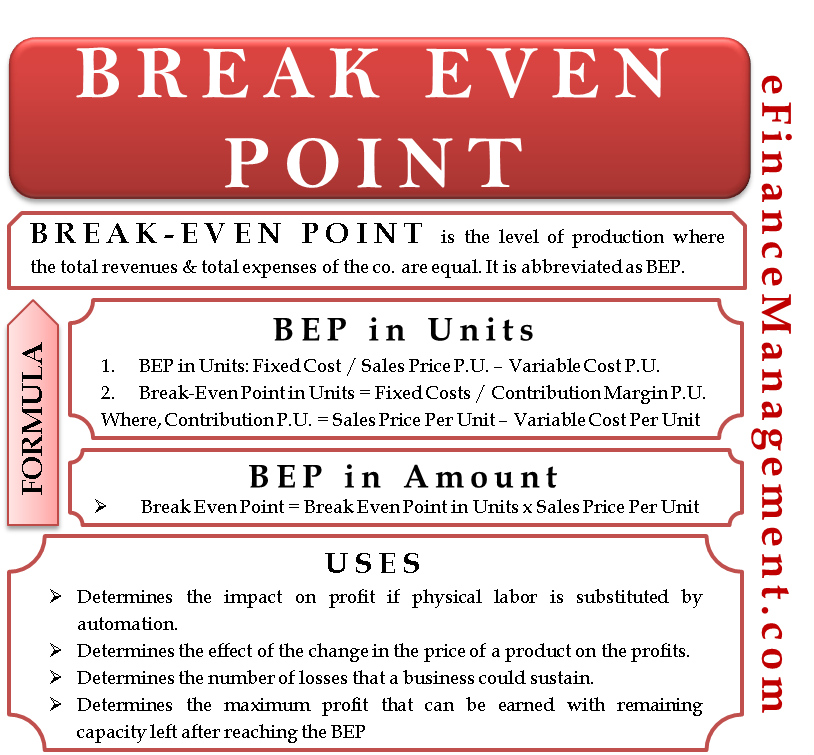

Note that the denominator of the above formula is the contribution margin per unit of production Example of Breakeven of Production The total fixed cost of a manufacturing company is $300,000, and the variable cost per unit produced is $150, andFullcapacity sales = Future sales level Percent of capacity used to generate existing sales level Fullcapacity sales = Existing sales level Percent of capacity used to generate existing sales level Fullcapacity sales Existing sales level (1 Percent of capacity used to generate existing level of assets) Full capacity sales Future sales level (1 Percent of capacity used to generate existing level of assets) Fullcapacity sales Future sales level (1 Percent of capacity Hence, for a system working at full capacity, it is the average quantity produced in a given time period If your system is working at less than capacity, however, you cannot take the total production quantity For example, if you produced ,000 gizmos per week, but half of the time your people were idling, then you cannot use the ,000

Store Capacity Calculator Retail Council Of Canada

Full Information Max Likelihood Estimates Of The Switching Regression Download Table

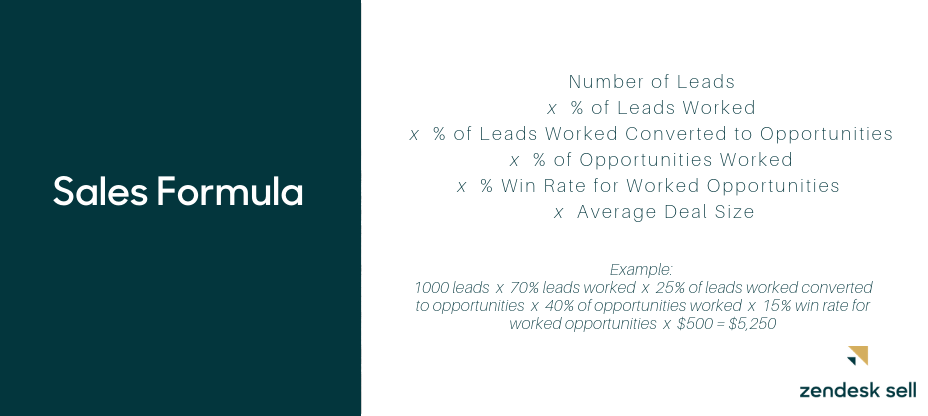

At its simplest, the formula for traditional Sales Capacity Planning = SR * H * W * CR * ST As an example, a sales team with seven reps, working 45 weeks per year, with a 30% closing rate and a 40% selling time, the formula would be Sales Capacity = SR (7) * H (40) * W (45 weeks / year) * CR (28%) * ST (40%) This results in a total sales capacity of 1081 sales/year for the team The potential output is 60,000 stickers By using the formula of capacity utilization, we get – Capacity Utilization = Actual Output / Potential Output * 100 Or, Capacity Utilization = 40,000 / 60,000 * 100 = 6667% From the above, we can also find out the slack of Funny Stickers Co during the last month of 17The maximum sales growth is the full capacity sales divided by the current sales, so Maximum sales growth = ($677,778 / $610,000) – 1 Maximum sales growth = 1111 or 1111% We are given the profit margin Remember that ROA = PM(TAT) We can calculate the ROA from the internal growth rate formula, and then use the ROA in this equation to find the total asset turnover

Financial Management Case Problem 6 2 Pg 221 Afn Equation Refer To Problem 6 1 What Additional Studocu

Defi Nition And Acceptable Range Of The Components Of Financial Capacity Download Table

Q7 In the formula Production capacity (in pieces) = (Capacity in hours*60/product SAMFull capacity sales = Actual sales Percentage of capacity at which fixed Assets were operated Next, management would calculate the firm's target fixed assets ratio as follows Total fixed as Sales Actual fixed assets Pull capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required levelFull capacity sales refers to the optimal sales amount, up to which situation a firm does not need the help of any external financing for the assets In this case, S Mfg Inc is currently operating at 92 percent of fixed asset capacity and its current sales are $690,000

Fixed Level Of Detail Expressions Tableau

Full Capacity Sales Actual Sales Percentage Of Chegg Com

1) Which of the following is true of financial institutions??a ?Financial institutions are the regulators of interest rates and other returns in financial marketsb ?Financial institutions require an understanding of factors that cause interest rates and other returns in the financial markets to rise and fallc ?Financial institutions are accountable and responsible in reporting financial American depository receiptse ?investment bankers3) What is the formula for calculating the fullcapacity sales of a firm??a ?Fullcapacity sales = Existing sales level ÃPercent of capacity used to generate existing sales levelb ?Fullcapacity sales = Future sales level Ã(1 Percent of capacity used to generate future sales level)cBased on its existing sales, what is the formula for calculating the fullcapacity sales of a firm?

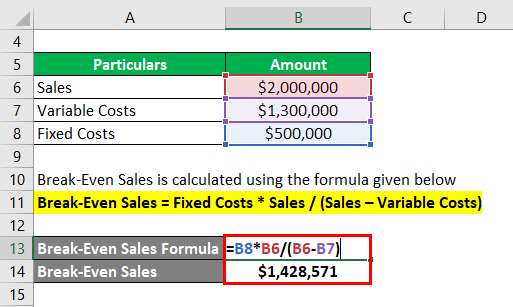

Break Even Sales Formula Calculator Examples With Excel Template

Cost Of Sales Definition Formula How To Calculate

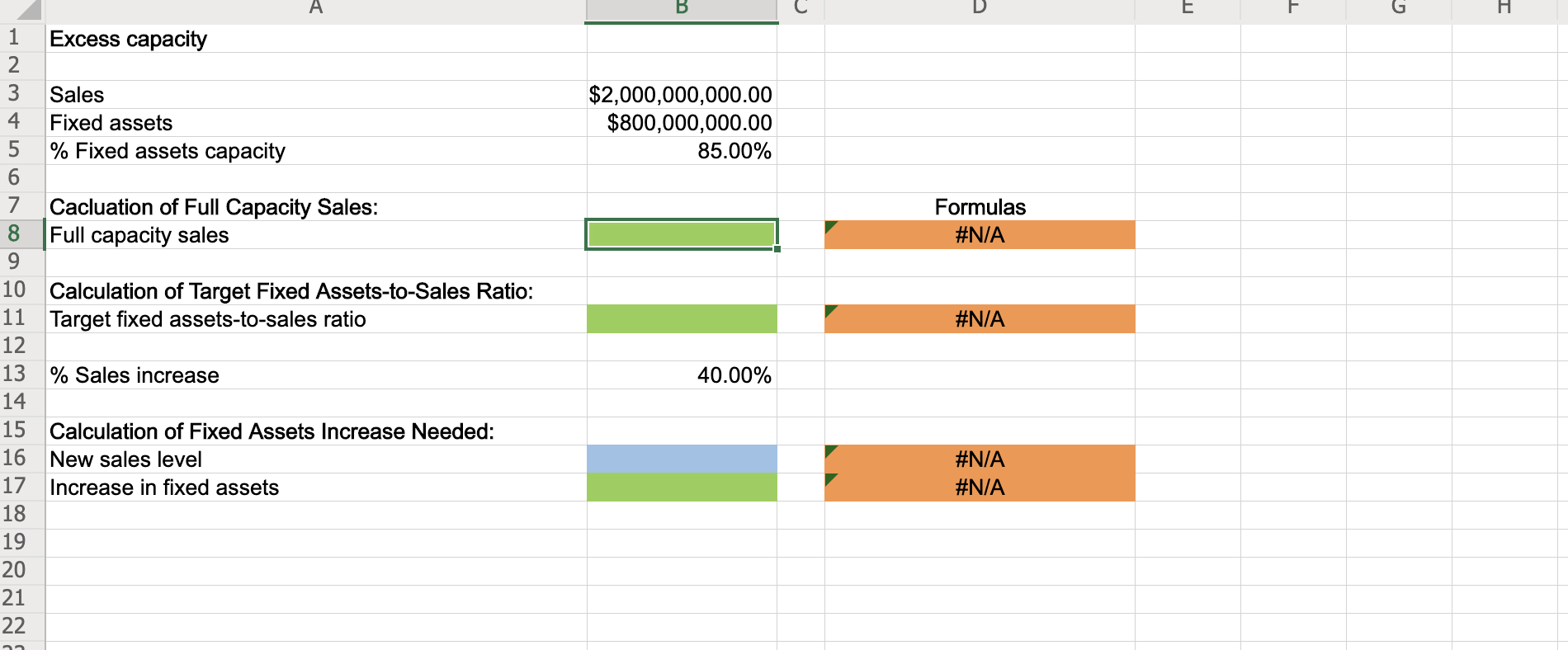

Again, this is a job for Tuning Your Revenue Engine as it will show you your current operational capacity so you can set the right sales goal to maximize your The Difference Between Operations and Strategy ceriusexecutives at 705 pm ReplyThis is the sales amount that can be used to, or contributed to, pay off fixed costs The concept of this equation relies on the difference between fixed and variable costs Fixed costs are production costs that remain the same as production efforts increase Variable costs, on the other hand, increase with production levelsCompare the projected sales to the full capacity sales to see if any increase in fixed assets is needed Projected sales are greater than full capacity sales, so there will be an increase in fixed assets The difference in projected sales and full capacity sales is $1,142,857, so you will use this number in the required level of fixed assets

3 Excess Capacity Adjustments Water And Power Co Chegg Com

2

Capacity costs include a wide range of cost types Some are fixed and are not affected by small shifts in business productivity Typical examples of Capacity is the maximum level of output that a company can sustain to make a product or provide a service Planning for capacity requires management to accept limitations on the production processFull capacity sales refers to the optimal sales amount, up to which situation a firm does not need the help of any external financing for the assets In this case, S Mfg Inc is currently operating at 92 percent of fixed asset capacity and its current sales are $690,000

Break Even Sales Formula Calculator Examples With Excel Template

How To Calculate Sales Revenue Definition Formula Video Lesson Transcript Study Com

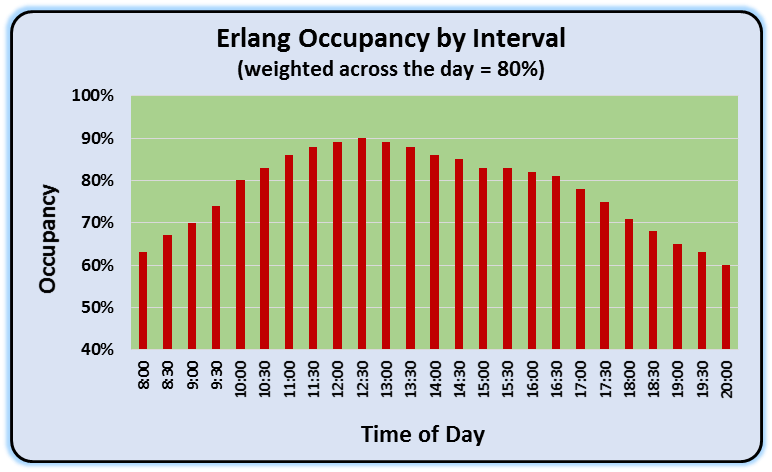

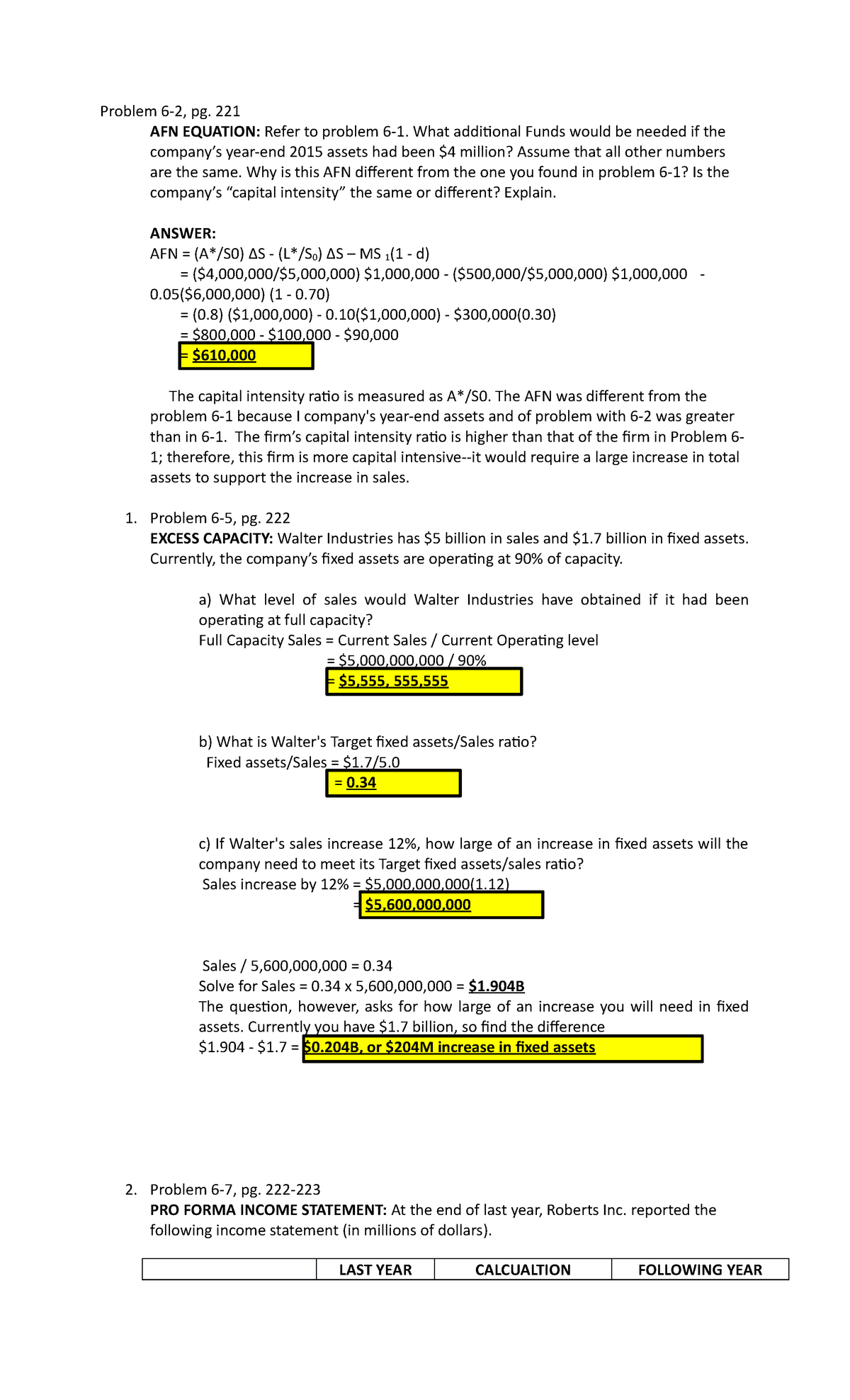

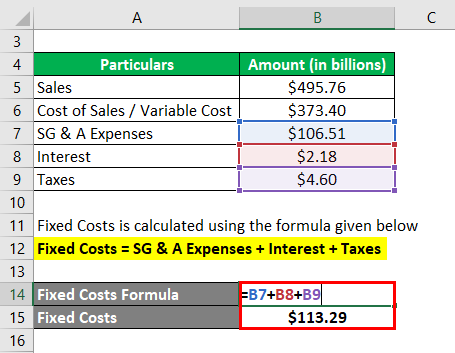

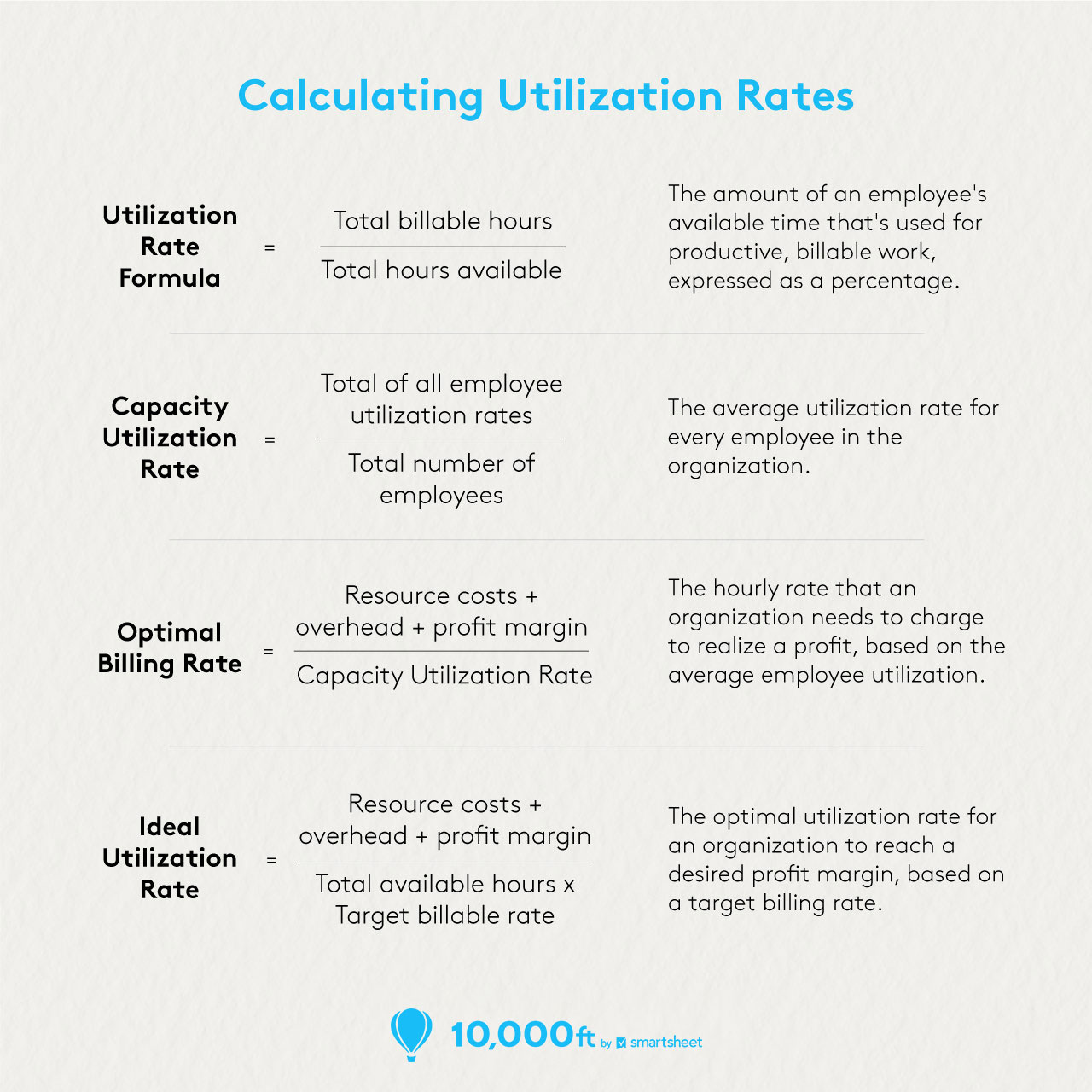

Formula for capacity utilization The formula for calculating capacity utilization is Capacity Utilization = (Actual level of output / maximum level of output) * 100Basics of the BreakEven Point The breakeven point is the dollar amount (total sales dollars) or production level (total units produced) at which the company has recovered all variable and fixed costs In other words, no profit or loss occurs at breakeven because Total Cost = Total Revenue illustrates the components of the breakeven pointThe AFN equation is as follows AFN = (A*/S 0)ΔS – (L*/S 0)ΔS – MS 1 (RR) Where A* = Assets tied directly to sales and will increase L* = Spontaneous liabilities that will be affected by sales (NOTE Not all liabilities will be affected by sales such as longterm debt) S 0 = Sales during the last year

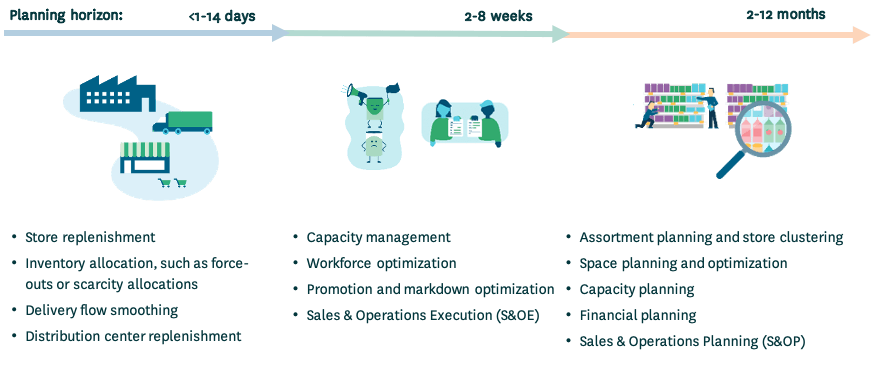

Demand Forecasting In Retail The Complete Guide Relex Solutions

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg)

Asset Turnover Ratio Definition Formula Examples

By using the formula of capacity utilization rate, we can calculate – Capacity Utilization Rate = (Actual output/Maximum possible output)*100 Capacity Utilization Rate = 60,000/80,000 Capacity Utilization Rate = 75 % From the above, we can also find out the slack of XYZ company during the last financial year of 16

Demystifying Service Level Calculation Freshcaller Blog

Break Even Sales Formula Calculator Examples With Excel Template

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Afn Equation Broussard Skateboard S Sales Are Expected To Increase By 15 From 7 0 Million In Homeworklib

Sales Capacity Model

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

Plowback And Dividend Payout Ratios Your Company Has

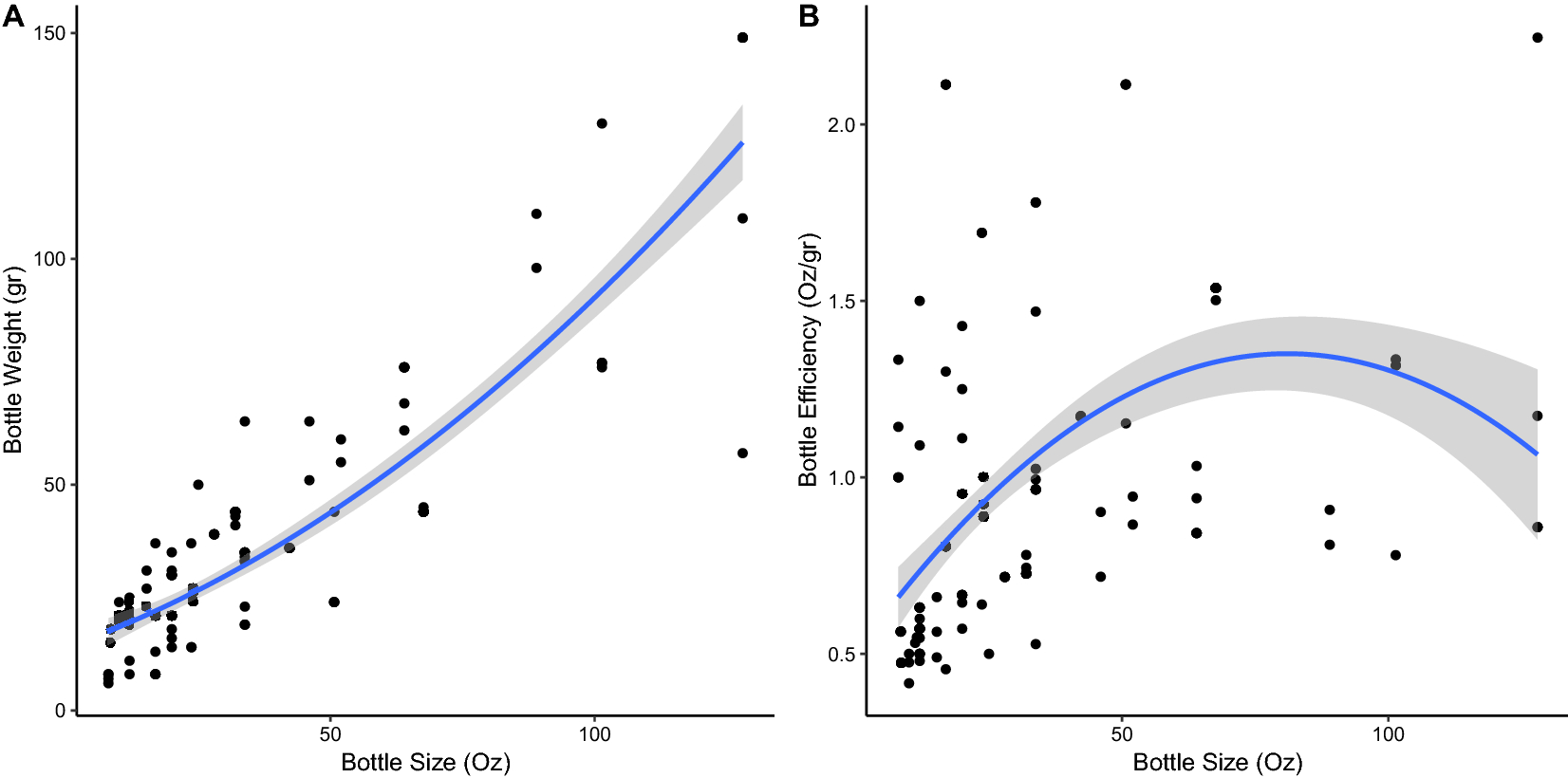

Beverage Bottle Capacity Packaging Efficiency And The Potential For Plastic Waste Reduction Scientific Reports

Cost Volume Profit Analysis

Solved 3 Excess Capacity Adjustments Western Gas Courses Archive

How To Calculate Production Capacity Of A Factory

Tailoring Tradeoffs For Simpler Portfolios Lower Costs And Happier Customers Mckinsey

7 1 Capacity Planning Saylor Bus300 Operations Management

Long Term Financial Planning And Growth Ch 4

Solved Direct Cost Per Unit As 3 Production Overhead Sales Costs Rs 156 000 Including Variable Costs Of Rs 30 000 Rs 80 000 Distribution Cost Course Hero

11 Sales Metrics That Highly Productive Teams Track

What Is Utilization How Do You Calculate Utilization Rate

Decomposition Tree Power Bi Microsoft Docs

Cost Volume Profit Analysis

2

Break Even Analysis Decision Making Skills Training From Mindtools Com

Long Term Financial Planning And Growth Ppt Download

Are You Calculating Your Sales Capacity Correctly Pivotal Advisors

Capacity Utilization Definition Example And Economic Significance

How To Calculate Sales Revenue Definition Formula Video Lesson Transcript Study Com

A E F G Hnmoon Doo 2 000 000 000 00 800 000 000 00 Chegg Com

Capacity Formula

Measurements Formula For The Production Department Accounting Financial Tax

Break Even Analysis Definition Formula Examples

Cost Volume Profit Analysis F5 Performance Management Acca Qualification Students Acca Acca Global

M3 Activity 1 Pdf Retained Earnings Dividend

Williamson Industries Has 7 Billion In Sales And 1 944 Bill Quizlet

6 Best Safety Stock Formulas On Excel Abcsupplychain

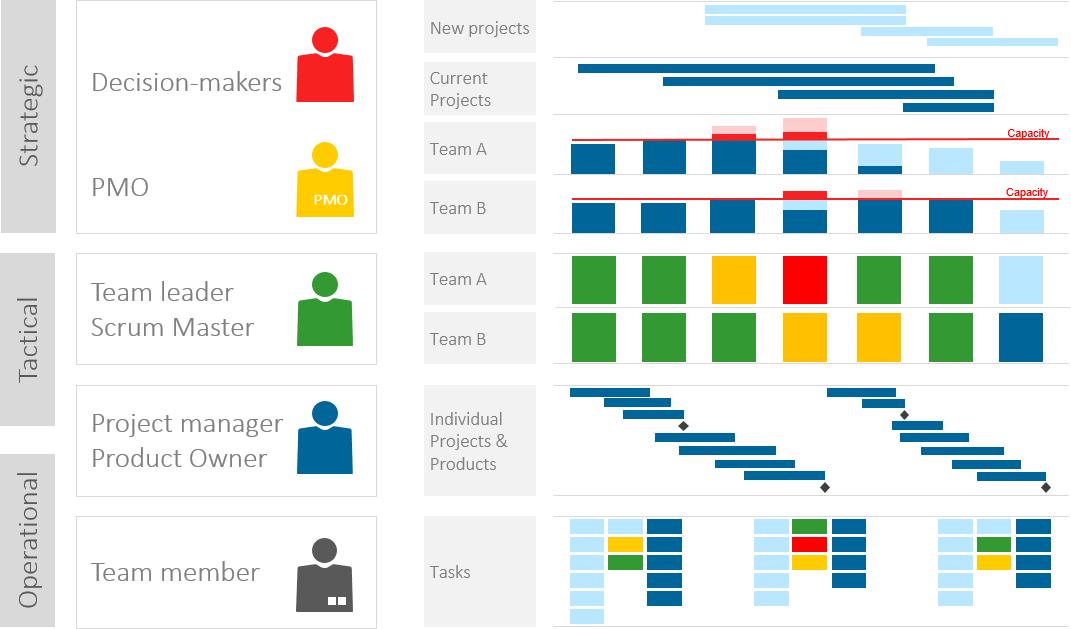

Capacity Planning In Project Management 4 Vital Success Factors Update 21

Working Capital Management Estimation And Calculation Taxmann Blog

Sales Commission Structures Everything You Need To Know Xactly

1

Time Driven Activity Based Costing

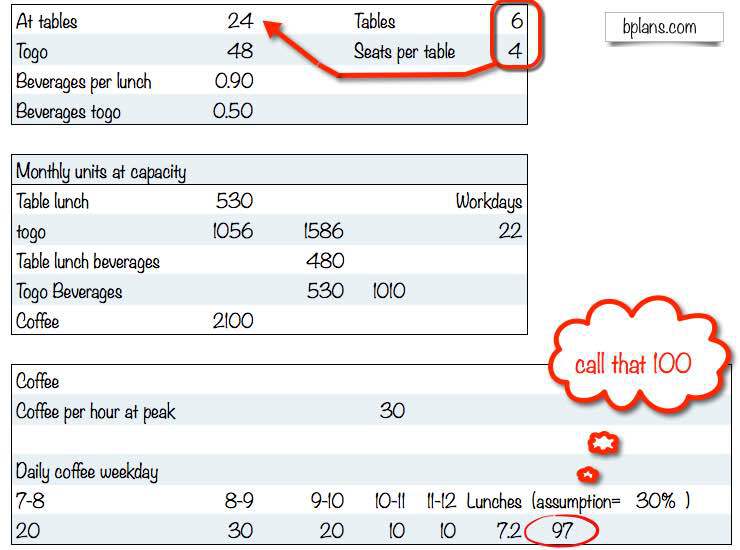

5 Steps To Build An Accurate Restaurant Sales Forecast In 21

What Is Revenue Run Rate Formula How To Calculate

Sales Objectives Examples Pipedrive

Long Term Financial Planning And Growth Ppt Video Online Download

Intratec Solutions Economics Of Methanol Production From Natural Gas Page 48 49 Created With Publitas Com

13 Important Sales Metrics And When To Use Them

Www Cambridge Org Us Download File 1343

Www Homeworkmarket Com Sites Default Files Qx 15 04 17 02 Principles Of Finance Part Ii Pdf

Capacity Planning 101 Building A Sales Plan

Sales Ramp Up Time Everything You Need To Know Xactly

Breakeven Sales Volume Ag Decision Maker

Sales Cost Of Goods Sold And Gross Profit

The Weighted Sales Pipeline How It Works And How To Create One For Your Company Propeller Crm Blog

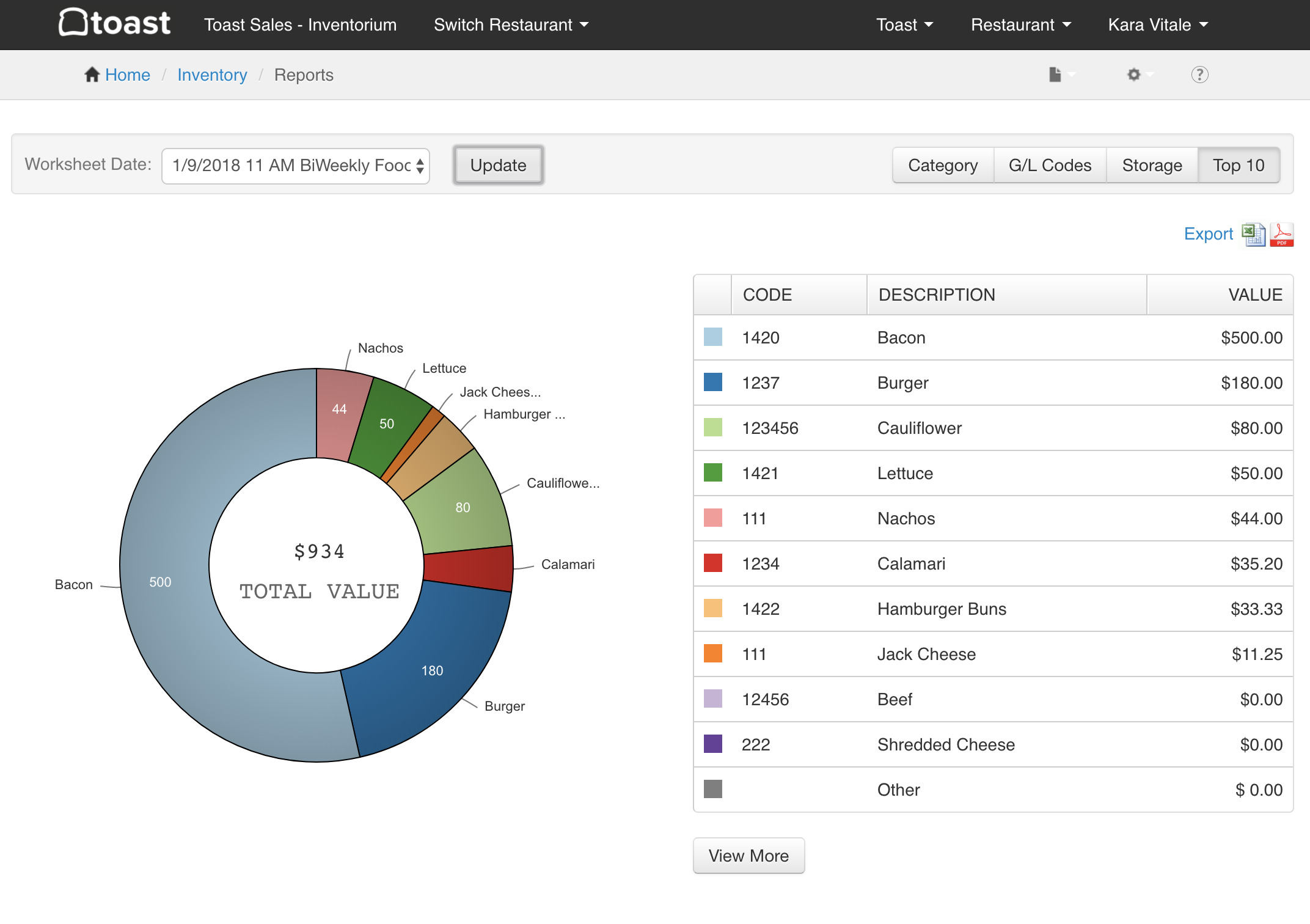

How To Conduct An Accurate Restaurant Sales Forecast Toast Pos

Towards The Sustainable Development Of Waste Household Appliance Recovery Systems In China An Agent Based Modeling Approach Sciencedirect

Sales Revenue Formula Calculate Grow Total Revenue

Chapter 5 Information For Decision Making

Determination Of Sales Volume In Rupees At Desired Level Of Profit In Accounts And Finance For Managers Tutorial 18 September 21 Learn Determination Of Sales Volume In Rupees At Desired Level

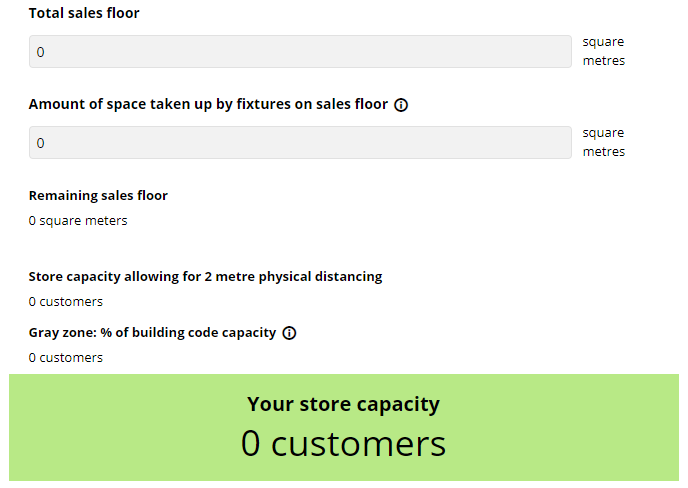

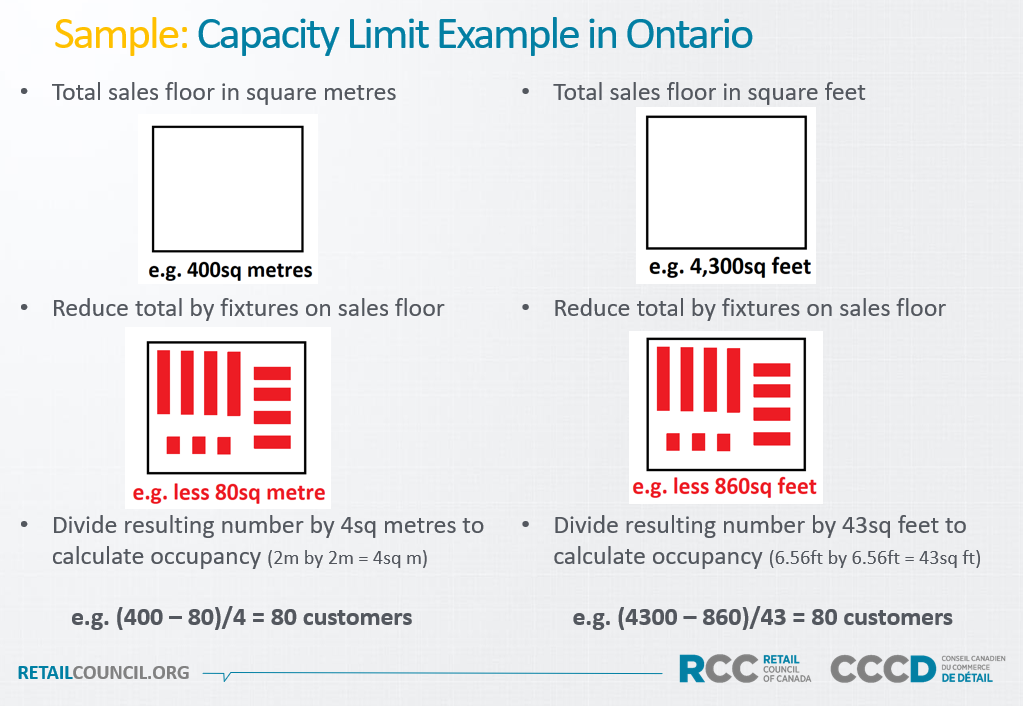

Ontario Rcc S Store Capacity Limit Calculation Tool Updated Retail Council Of Canada

How To Effectively Determine Your Market Size

How To Calculate Workplace Productivity Smartsheet

Break Even Point Definition Formula Example Uses Etc

/GrossProfitMargin-5c7cdf1546e0fb0001edc877.jpg)

Profit Margin Formula Uses How To Calculate

Calculating Breakeven Output Formulae Tutor2u

1

Understanding Capacity Utilization Rates Wrike

Capacity Utilization Formula

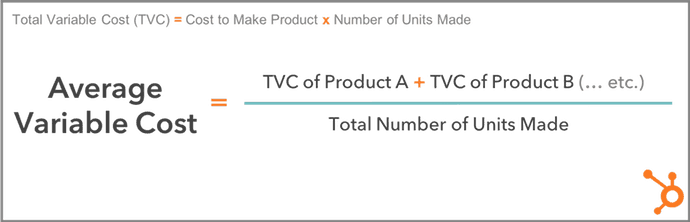

Variable Cost Explained In 0 Words How To Calculate It

Capacity Planning 101 Building A Sales Plan

How To Calculate Overall Equipment Effectiveness A Practical Guide Automation World

4 Excess Capacity Adjustments Monk Consortium Corp Monk Con Currently Has 540 000 In Total Assets And Sales Homeworklib

Contribution Margin Ratio Revenue After Variable Costs

Edexcel A Level Business Calculation Practice Business Tutor2u

Break Even Sales Formula Calculator Examples With Excel Template

Presentation On Project Finance Organised By Institute Of

The Impact Of Covid 19 On Sales And Production The Cpa Journal

2

Sales Revenue Formula Calculate Grow Total Revenue

0 件のコメント:

コメントを投稿